Oklahoma City Bankruptcy Lawyer: Your Guide to Financial Relief

Facing overwhelming debt in Oklahoma City can feel like being trapped in a financial storm with no clear path to shelter. The constant calls from creditors, the looming threat of foreclosure or repossession, and the stress of managing impossible payments can drain your hope and energy. However, the law provides a structured, legal process designed not to punish, but to offer a genuine fresh start. Navigating this process successfully, however, requires expert guidance tailored to Oklahoma’s specific legal landscape and your unique circumstances. An experienced Oklahoma City bankruptcy lawyer is not just a legal representative, they are a strategic partner who can help you understand your options, protect your most valuable assets, and guide you toward a stable financial future.

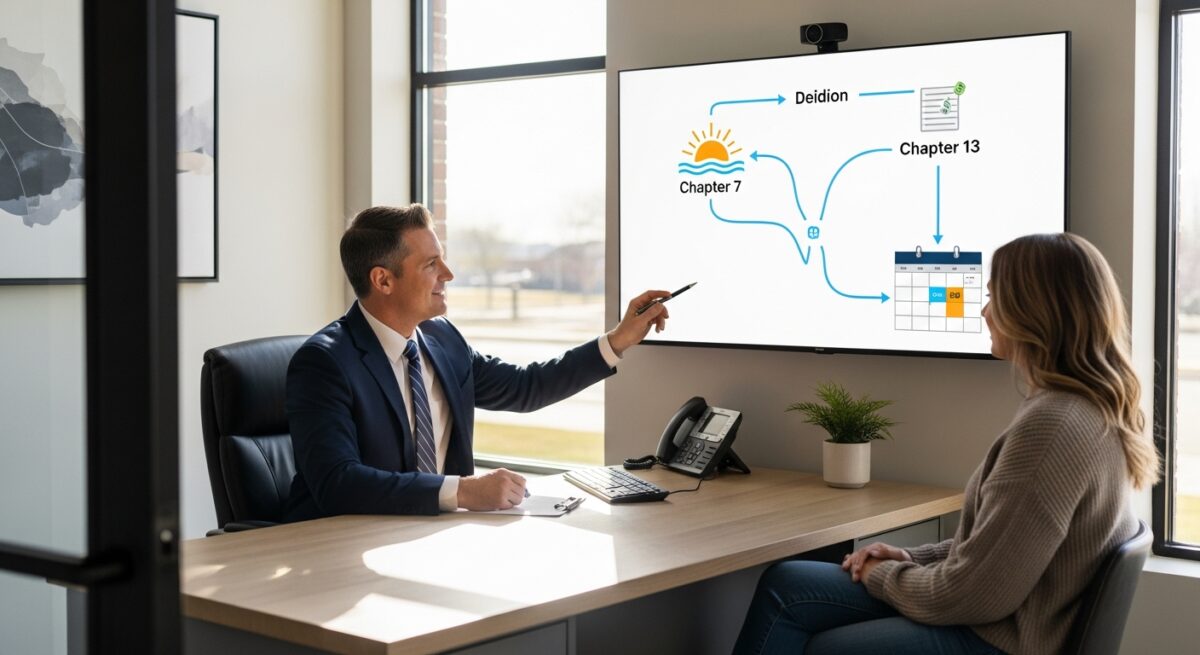

Understanding Bankruptcy Chapters and Your Options

The decision to file for bankruptcy is significant, and it begins with understanding which chapter of the U.S. Bankruptcy Code applies to your situation. For individuals and married couples in Oklahoma City, the two primary chapters are Chapter 7 and Chapter 13. Each serves a different purpose and has distinct eligibility requirements and outcomes. A knowledgeable attorney will conduct a thorough analysis of your income, debts, assets, and goals to recommend the most advantageous path forward. This analysis often involves comparing the liquidation process of Chapter 7 with the reorganization plan of Chapter 13, a decision that can impact your property for years to come.

Chapter 7 bankruptcy, often called “liquidation,” is designed for those with limited income who cannot repay their unsecured debts. It involves the appointment of a trustee who may sell certain non-exempt assets to pay creditors. However, Oklahoma has specific exemption laws that protect essential property, such as equity in your home, your vehicle, retirement accounts, and personal belongings. A skilled Oklahoma City bankruptcy attorney will meticulously apply these exemptions to shield as much of your property as legally possible. The process typically concludes within a few months, resulting in the discharge (elimination) of qualifying debts like medical bills and credit card debt.

Chapter 13 bankruptcy, known as a “wage earner’s plan,” is for individuals with a regular income who can repay a portion of their debts over time. Instead of liquidating assets, you propose a three to five-year repayment plan to the court. This chapter is particularly powerful for stopping foreclosure, as it allows you to catch up on missed mortgage payments through the plan. It can also help you restructure other secured debts, like car loans, and potentially reduce the principal balance on certain junior liens. The role of your lawyer here is critical: to craft a feasible plan the court will confirm and to advocate for you throughout the lengthy process.

The Critical Role of Your Bankruptcy Attorney

Hiring a dedicated Oklahoma City bankruptcy lawyer transforms a complex, intimidating legal procedure into a managed, strategic process. Their expertise extends far beyond simply filling out paperwork. From the initial consultation to your final discharge, they provide essential services that protect your rights and your property. One of their first and most important duties is to conduct a means test analysis to determine your eligibility for Chapter 7 or the required plan payment for Chapter 13. This calculation is governed by strict formulas and median income data for Oklahoma, and an error can lead to dismissal of your case or an unaffordable plan.

Your attorney also serves as your shield against creditor harassment. Once you retain an attorney and especially after your case is filed, an automatic stay immediately goes into effect. This federal court order forces creditors to stop all collection actions, including calls, lawsuits, wage garnishments, and foreclosure proceedings. Your lawyer will handle all communication with the bankruptcy trustee and creditors, ensuring you are not pressured or misled. They prepare you for the 341 meeting of creditors, a mandatory hearing where the trustee and any appearing creditors can ask questions about your petition. With your counsel by your side, this meeting is typically a brief, straightforward procedure.

Perhaps most importantly, a local attorney understands the nuances of Oklahoma exemption laws and the tendencies of the local bankruptcy trustees and judges. For example, understanding how Oklahoma’s homestead exemption interacts with federal rules, or how a trustee might value a vehicle or household goods, is knowledge gained through experience. This localized insight is invaluable for maximizing the protection of your assets. As explored in our resource on how a Cleveland bankruptcy lawyer can help you rebuild, the right legal guidance is foundational to not just surviving the process, but thriving after it.

Key Benefits of Filing for Bankruptcy in Oklahoma City

The benefits of pursuing bankruptcy with professional legal counsel are substantial and life-changing. While the primary goal is debt relief, the advantages ripple out to improve your overall mental and financial well-being. The immediate halt to creditor pressure provides profound emotional relief, allowing you to think clearly and plan for the future. Beyond the automatic stay, a successful bankruptcy leads to a discharge order, which legally releases you from personal liability for specific debts. This means creditors can never again attempt to collect on those discharged obligations.

For many, bankruptcy is the tool that saves their family home from foreclosure or their primary vehicle from repossession. In a Chapter 13 case, you can strip wholly unsecured second mortgages or car loans, potentially saving tens of thousands of dollars. The process also helps you rebuild your credit more strategically. While a bankruptcy filing will impact your credit score, it also stops the negative reporting of past-due accounts. This allows you to begin rebuilding credit immediately, often from a clearer baseline than the pre-filing cycle of missed payments and collections. Many clients find they can qualify for new, responsible credit sooner than they anticipated.

To summarize, the core benefits provided by working with an Oklahoma City bankruptcy lawyer include:

- Immediate relief from creditor calls, lawsuits, wage garnishment, and foreclosure actions via the automatic stay.

- Expert application of state and federal exemption laws to protect your home, car, retirement funds, and personal property.

- Strategic guidance in choosing between Chapter 7 liquidation and Chapter 13 reorganization based on your assets and income.

- Professional preparation and representation for all court hearings and trustee meetings.

- A legal pathway to permanently eliminate qualifying unsecured debts and gain a enforceable fresh start.

The Bankruptcy Process: What to Expect Step by Step

Knowing what lies ahead can alleviate much of the anxiety surrounding a bankruptcy filing. When you work with a competent law firm, the process follows a structured timeline. It begins with a comprehensive consultation where you provide detailed information about your finances. Your attorney will then gather necessary documents, such as tax returns, pay stubs, bank statements, and debt statements, to prepare your petition. This petition is a lengthy, sworn document that lists all your assets, liabilities, income, expenses, and financial transactions. Accuracy is paramount, and your lawyer ensures every section is complete and correct before filing.

Once filed with the Oklahoma City bankruptcy court, the automatic stay takes effect, and the court assigns a trustee to administer your case. You will then attend the 341 meeting with your attorney. Following this, in a Chapter 7 case, you typically just await your discharge order after the trustee concludes any asset review. In a Chapter 13 case, your attorney will draft your repayment plan, attend a confirmation hearing to get it approved by the judge, and then guide you through making 36 to 60 months of successful payments. Throughout this multi-year journey, your lawyer is there to handle modifications if your financial situation changes and to ensure you remain in compliance with the court’s requirements. The process of achieving financial freedom through structured legal guidance is similar to the approach detailed in our article about how a bankruptcy lawyer in Tucson can guide you to a stable future.

Frequently Asked Questions About Bankruptcy

Will I lose everything I own if I file for bankruptcy?

No. This is a common misconception. Oklahoma exemption laws, along with federal exemptions in some cases, protect essential property. Your attorney’s job is to use these laws to shield your home equity (within limits), your primary vehicle, household goods, retirement accounts, and tools of your trade. Most Chapter 7 cases are “no-asset” cases, meaning no property is liquidated because it is all exempt.

How long does bankruptcy stay on my credit report?

A Chapter 7 bankruptcy can remain on your credit report for up to 10 years from the filing date, while a Chapter 13 remains for up to 7 years. However, its impact on your ability to get credit diminishes over time, especially if you demonstrate responsible financial behavior after your discharge.

Can I file for bankruptcy without a lawyer?

While it is legally possible to file “pro se” (representing yourself), it is highly discouraged. Bankruptcy law is extremely complex, and mistakes can lead to your case being dismissed, losing property you could have protected, or even allegations of fraud. The cost of an attorney is often outweighed by the value of the assets they protect and the peace of mind they provide.

What debts cannot be discharged in bankruptcy?

Certain debts are generally non-dischargeable, including most student loans, recent tax debts, child support, alimony, and debts arising from fraud or willful injury. Your attorney will review your debts during the consultation and explain which obligations will likely survive the bankruptcy.

How much does it cost to hire an Oklahoma City bankruptcy lawyer?

Fees vary based on the complexity of your case and the chapter filed. Most attorneys offer a free initial consultation to discuss your situation and provide a clear fee structure. Chapter 7 fees are often a flat rate, while Chapter 13 fees are typically paid in part upfront and the remainder through your court-approved repayment plan.

Taking the step to consult with an Oklahoma City bankruptcy lawyer is an act of proactive problem-solving, not defeat. It is the first move in a strategic plan to regain control of your finances and your life. By understanding the process, your rights under Oklahoma law, and the powerful protections available, you can move forward with confidence toward a debt-free future. The path to financial stability is well-defined, and with expert legal guidance, you can navigate it successfully.

Recent Posts

How to Pay a Bankruptcy Lawyer: Fees, Plans, and Options

Explore flexible options for how you pay a bankruptcy lawyer, including payment plans and fee structures. Call (833) 227-7919 to discuss your specific situation.

How to Find a Bankruptcy Lawyer and Secure Financial Relief

Get a clear roadmap to find a bankruptcy lawyer who can protect your assets and secure debt relief. Call (833) 227-7919 for a confidential case evaluation.

Navigating Bankruptcy Litigation: When You Need a Specialized Lawyer

Facing a bankruptcy dispute requires a specialized advocate. Contact a bankruptcy litigation lawyer at (833) 227-7919 for strategic defense.